1. Executive Summary

Firm Name & Location. Bayside Legal Group, PLLC — Miami, Florida (serving Miami-Dade, Broward, Palm Beach).

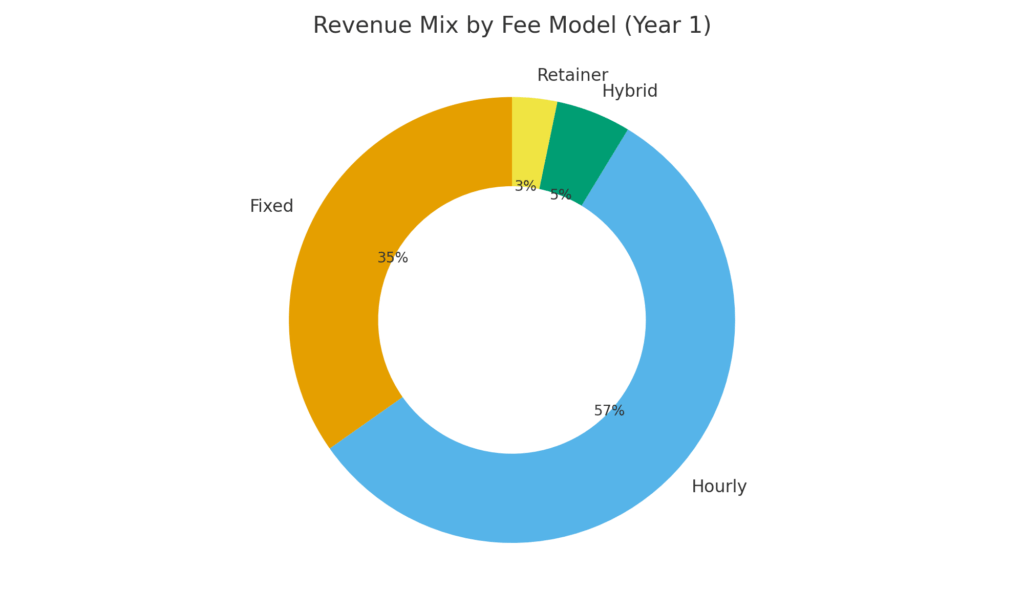

Business Concept. This law firm business plan outlines a boutique practice focused on Corporate/Commercial, Employment, and Commercial Litigation, with selective IP (trademarks/licensing). Our delivery model blends fixed-fee menus for repeatable work (formations, handbooks, contract packages), hourly for complex matters and disputes, and hybrid/partial-contingency where ethics permit. Transparent pricing, rapid intake, and business-minded counsel are the core of our law firm business plan template in action.

Mission. Provide business-grade legal outcomes with clear scopes, predictable fees, and responsive communication so operators can move faster with less risk.

Vision. Become the go-to counsel for SMBs and founders in Greater Miami by Year 3, with top-quartile client satisfaction and matter profitability.

Ownership & Legal Form. Florida PLLC owned by two equity partners; malpractice coverage maintained; IOLTA/trust procedures documented and audited monthly.

| Key Metrics (Targets) | Y1 | Y2 | Y3 |

|---|---|---|---|

| Revenue | $920,000 | $1,350,000 | $1,900,000 |

| Net Margin | 18–20% | 24–26% | 28–30% |

| Utilization (Associates) | 72% | 75% | 78% |

| Realization Rate | 90–92% | 92–94% | 94–95% |

| Break-Even (month) | M7 | — | — |

Funding Requirement. $165,000 for startup and 6-month runway: office fit-out & furniture ($55k), tech stack & licenses ($22k), marketing/website ($28k), insurance & compliance ($15k), and working capital ($45k).

Market Opportunity. Miami’s expanding SMB base, strong formation activity, and sustained litigation volume create a solid pipeline. Competition is fragmented; demand is shifting toward predictable fee structures, faster intake, and practical advice—precisely what this law firm business plan delivers.

2. Firm Description

Background. Bayside Legal Group was founded by two partners who spent a decade serving Florida operators across hospitality, construction trades, logistics, and healthcare. The gap we kept seeing: slow intake, vague scoping, and invoices that surprised clients. We built the opposite—fast triage, plain-English scopes, and billing that matches value delivered. Ethically rigorous, commercially minded.

Practice Areas.

- Corporate/Transactions: formations, founder/operating agreements, commercial contracts, vendor/customer T&Cs, asset purchases/M&A (sub-$15M EV), commercial leases.

- Employment: handbooks, wage/hour compliance, independent-contractor audits, restrictive covenants, investigations, counseling on disputes.

- Commercial Litigation: breach of contract, injunctions, collections, ADR/mediation; selective state/federal matters with phased budgets.

- IP (selective): trademarks, licensing, brand protection for consumer/hospitality concepts.

- GC-as-a-Service (retainers): monthly blocks covering contract flow, HR hygiene, and owner/board questions with SLAs.

Objectives (SMART).

- Reach $1.35M revenue and 25%+ net margin by Year 2.

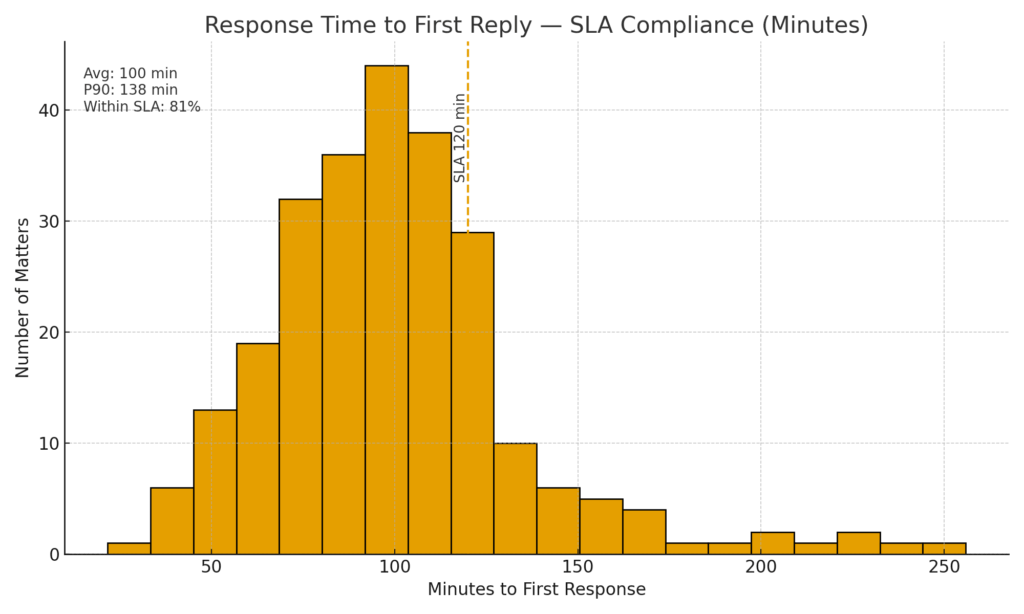

- Maintain NPS ≥ 70 and average intake response time < 2 business hours by Month 6.

- Hold realization ≥ 92% and DSO ≤ 28 days through disciplined scoping and billing cadence.

Values & Culture. Professionalism and confidentiality are table stakes; we add plain talk, predictable process, and measurable outcomes. Diversity and inclusion reflect Miami’s mosaic. Continuous learning (quarterly training, post-matter retros, template/version control) keeps quality high. Compliance (conflicts, IOLTA, data security) is non-negotiable.

Note: Throughout the full document we’ll naturally integrate relevant queries (e.g., law firm business plan example, law firm business plan template, small/solo law firm business plan) where they make sense contextually—without stuffing and always in service of clarity.

3. Industry & Market Analysis

Purpose. Map how the legal market in Miami actually behaves so we place Bayside where demand, price, and speed line up.

3.1 Industry Overview

Structure. The market splits into three layers: (1) solos/boutiques that win on access, specialization, and price flexibility; (2) mid-size regionals with deeper benches, higher rates, and slower intake; (3) BigLaw for high-stakes or national matters with premium pricing and long lead times. Miami adds a twist—heavy cross-border work and a large SMB base that needs fast, practical answers, not 40-page memos.

- Local dynamics. Competition is fragmented. Many firms market broadly but execute in narrow lanes (e.g., PI, immigration, real estate). Response time and fee clarity are the main battlegrounds for SMB work.

- Trends. Alternative Fee Arrangements (AFAs) are moving from “nice-to-have” to expected for repeatable work. Legal tech (case management, e-sign, client portals, document automation) is now table stakes. Clients judge firms on speed and clarity as much as outcomes. Niche plays (e.g., hospitality employment, construction contracts, Amazon/e-com brand work) earn outsize referral pull.

- Regulatory environment. Florida Bar advertising and solicitation rules require disciplined marketing. IOLTA/trust accounting demands documented procedures and audits. Contingency or hybrid fees in certain matters must align with ethics rules; engagement letters and scope caps are essential.

3.2 Market Size & Growth

- SMB formation & growth. Miami-Dade and Broward continue to add new entities—hospitality, construction trades, logistics, healthcare services, and e-commerce are active. New-company formation is a leading indicator for formation packages, contracts, and employment basics.

- Disputes. Commercial disputes remain durable (contract breaches, collections, employment claims). Mediation and ADR are common, but filings volume still supports a steady litigation pipeline.

- Segment split. For boutiques like ours, revenue typically skews to corporate advisory and employment for recurring, predictable work, with disputes providing episodic spikes. Personal services (trademarks for consumer brands; selective estate planning) act as cross-sell and referral feeders.

3.3 Target Clients

- SMBs & Startups. 5–250 employees; need formations, founder documents, vendor/customer contracts, and employment hygiene. Pain points: slow response, opaque pricing, and advice that ignores business realities.

- Middle-Market. $10–$150M revenue; seek fast counsel for disputes, M&A “lite,” and compliance fixes. Pain points: BigLaw rates, poor visibility on phases and costs.

- Individuals (select). Founders and key executives with employment claims/defense or estate planning needs tightly connected to their operating businesses.

What they want, in plain English: predictable fees where possible, a clean intake experience, realistic timelines, and counsel that ties risk to P&L and brand—not just case law.

3.4 Competitive Analysis

Landscape summary. Miami has well-known boutiques in PI/immigration/real estate and a long tail of generalists; a handful of regional firms cover commercial work at higher price points. Response SLAs and documentation (what’s included, when, and for how much) separate the keepers from the churn.

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Niche expertise; AFAs and fixed menus; modern intake with client portal | New brand; limited initial bench size | SMB growth; content-led SEO; GC-as-a-Service retainers | Price pressure from solos; lateral poaching; rate inflation at vendors/experts |

Positioning for Bayside. Mid-price, business-first boutique: fixed-fee where repeatable, phased budgets for disputes, rapid intake, and updates clients can actually read. We publish scopes and timelines to reduce shopping friction and raise realization.

3.5 Market Gaps & Strategy

- Gap: predictability. Many firms still quote “it depends.” We publish fixed-fee menus for formations, handbooks, contract packages, and demand letters; litigation uses phased budgets and decision gates.

- Gap: speed & clarity. Intake within 2 business hours; conflict check, scope, and engagement letter in a single workflow; client portal with milestones and documents.

- Gap: business-minded advice. We frame options by cost, timing, risk bands, and operational impact. Short memos, clear next steps.

- Strategy highlights. Unbundled startup services (formation + starter contracts), GC-as-a-Service retainers for scale-ups, and targeted niches (hospitality employment, construction contracts, e-com brand protection). Content-led SEO and referrals (CPAs, brokers, HR consultants) feed the funnel.

Bottom line: This is a law firm business plan built for Miami’s pace—predictable fees where possible, fast communication always, and advice that moves the business, not just the docket.

4. Legal Services & Pricing

4.1 Service Lines

- Corporate / Transactions. Formation (LLC/Corp), founder & operating agreements, commercial contracts (MSA/SOW, vendor/supply, SaaS/DPAs), cap table hygiene, M&A lite (asset purchases, membership interest transfers), and commercial lease review/negotiation.

- Employment. Handbooks and policies, wage/hour and contractor compliance, restrictive covenants, internal investigations, manager training, and pre-litigation counseling on disputes.

- Litigation. Commercial disputes (breach of contract, business torts, collections), injunctions, mediation/ADR; selective state/federal matters with phased budgets and decision gates.

- IP (brand-focused). Trademarks (search, filing, office actions), licensing, and brand protection for consumer/hospitality and e-commerce concepts.

- Real Estate / Trusts & Estates (selective). Commercial lease packages and basic estate instruments for owner-operators where it aligns with the core relationship.

4.2 Fee Models

| Service | Fee Model | Indicative Range (USD) | Notes |

|---|---|---|---|

| LLC Formation + Operating Agreement | Fixed Fee | $950–$1,800 | State filing fees & registered agent extra; rush available |

| Contract Review (≤ 15 pages) | Fixed / Hourly | $450–$750 / $285–$385 per hour | 48–72h turnaround; redlines + risk memo included |

| Demand Letter | Fixed | $550–$1,100 | Includes intake consult and one revision cycle |

| Commercial Litigation | Hourly / Hybrid | $295–$495 per hour | Phase budgets; success fee or fee-shift where permitted |

| GC-as-a-Service (SMB Retainer) | Monthly Retainer | $1,500–$5,000 per month | Scope caps, SLAs, quarterly strategy review |

Discounts & Alternative Pricing. Startup bundles (formation + contracts) at 10–15% off the à-la-carte total; capped phases for litigation and deals; volume discounts for multi-matter retainers; success fee or partial contingency where ethics allow; nonprofit rate card on approval.

Why this works. Repeatable work gets fixed fees for predictability. Complex or evolving matters use hourly/hybrid with phased budgets so clients see spend before it happens. It’s a practical, investor-friendly approach in a modern law firm business plan—and it keeps realization high without surprises.

5. Marketing & Sales Strategy

5.1 Positioning & Brand

Who we are in one line: Business-first lawyers with clear timelines, affordable predictability, and practical risk framing. We publish scopes, we call our shots, and we don’t hide the ball on price. Brand voice: plain English, direct, steady. Visuals: clean, minimal, trust-forward (no gavels, no Latin).

- Value promise: “Outcomes, timing, and cost—up front.”

- Proof: fixed-fee menus, SLAs for response, phased budgets for disputes, sample deliverables (sanitized).

- Signals: case studies, short memos with decision trees, star ratings and client quotes (with permission).

5.2 Acquisition

Digital. We build a compounding engine rather than one-off bursts.

- Website with intake scheduling: click-to-book consult; conflict check triggers on submit.

- Practice-area pages: Corporate/Transactions, Employment, Commercial Litigation, Trademarks—each with fixed-fee examples and timelines.

- Local SEO & Google Business Profile: location pages for Miami, targeted service pages (e.g., “LLC formation Miami,” “employee handbook Miami”). Internal linking from a law firm business plan resource hub (how-tos, checklists, templates).

- Content (how-tos & templates): “How to write an employment policy,” “Founder checklist for vendor contracts,” “Demand letter template (commercial).” Calls-to-action to fixed-fee packages.

- Google Ads (high intent): exact/phrase on “contract lawyer near me,” “LLC operating agreement lawyer,” “commercial litigation attorney Miami.” Landing pages mirror the query and show price bands.

- LinkedIn thought leadership: weekly shorts (150–250 words) on risk framing, contract pitfalls, hiring/IC tests; cross-post to the site.

Offline. Warm networks beat cold spend.

- Referrals: CPA firms, fractional CFOs/CHROs, business brokers, HR consultants—co-authored guides and co-branded webinars.

- Chambers & associations: targeted committees (hospitality, construction, e-commerce).

- Speaking & clinics: monthly startup legal clinic; quarterly “GC for a Day” workshops for owner-operators.

- Incubators: office hours for accelerators; discounted startup bundles with clear upgrade paths.

5.3 Intake & Conversion

Frictionless path from click to engagement.

- Conflict check & triage (T+2h): form routes to coordinator; conflict system pings; green matters get a same-day slot.

- Consult (20–30 min): define outcome, timeline, decision points. No free-for-all—tight agenda.

- Transparent proposal: scope, fee model (fixed/hourly/hybrid), phase budgets, assumptions, and what’s not included.

- Engagement letter + invoice link: e-sign + card/ACH; IOLTA rules followed for retainers/advances.

- Kickoff & plan: milestones in client portal; target dates; primary contact.

Micro-optimizations that move the needle: 2-step calendar embed on landing pages, auto-text reminders, 24-hour follow-up if a proposal is unopened, and one “no-pressure” nudge at 72 hours with a mini-FAQ.

5.4 Retention & Referrals

- Client portal cadences: weekly matter updates by default; “quiet weeks” still get a heartbeat note.

- Quarterly legal checkups (GC retainers): dashboard review (contracts, HR hygiene, disputes, IP renewals) with a 90-day action list.

- Closed-matter wrap: 1-page summary (result, lessons, next actions) + optional review request link.

- Referral flywheel: thank-you notes to referrers with anonymized outcomes; invite them to co-host next clinic or guide.

5.5 KPIs

| Metric | Target | Why it matters |

|---|---|---|

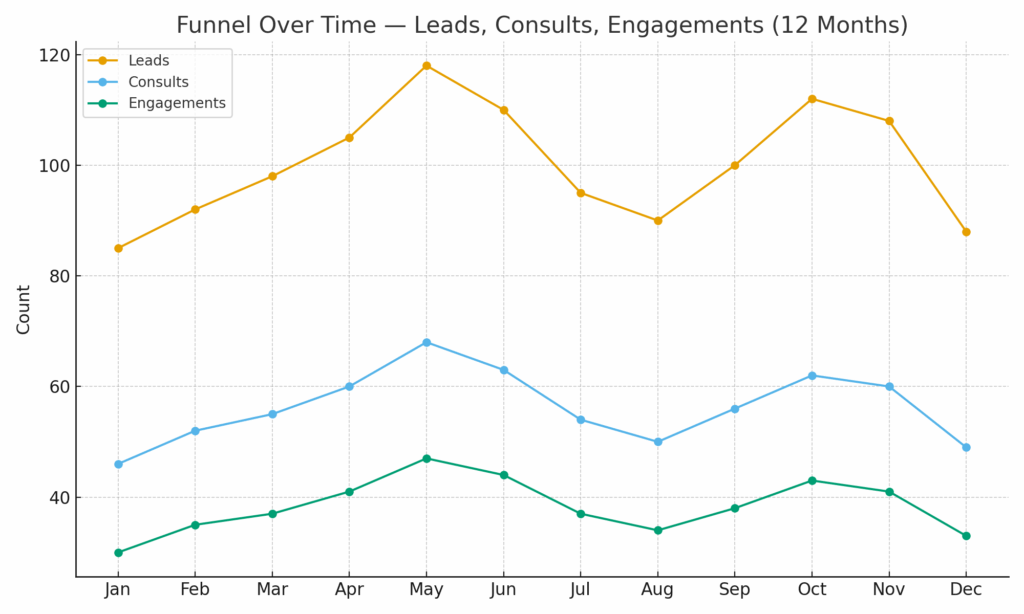

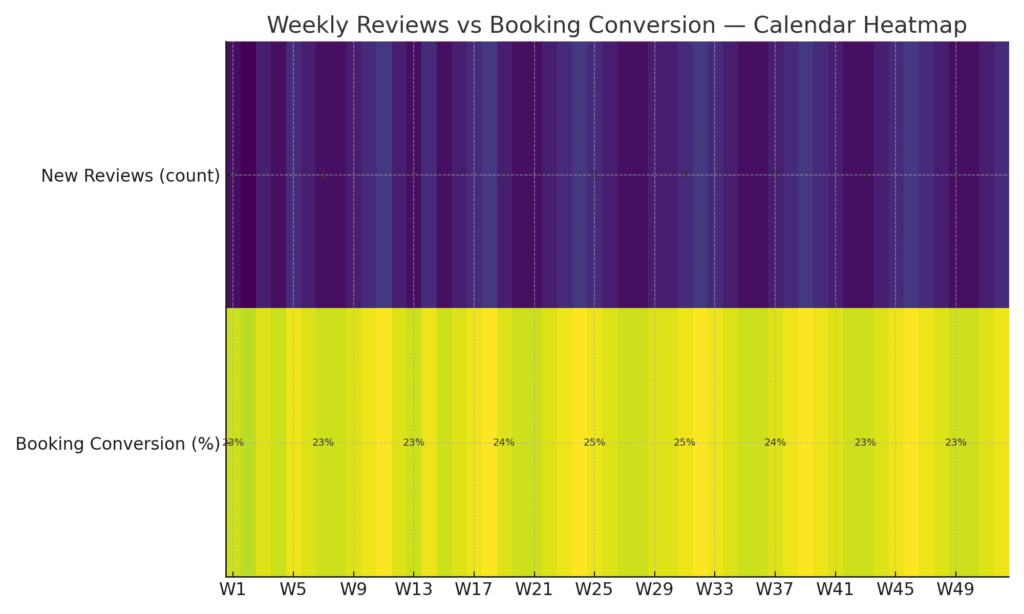

| Leads → Consult → Engagement (conversion) | 35% → 70% → 65% | Shows funnel health and message-to-market fit |

| Cost per consult (CPCON) | < $220 | Signals paid/organic efficiency and landing page match |

| Time to first response | < 2 business hours | Speed wins; lifts conversion and perceived quality |

| Realization rate | ≥ 92% | Scope control; fewer write-downs |

| Referral rate | ≥ 25% of new matters | Trust & experience turning into pipeline |

| Review velocity | 4–6 new reviews/month | Local SEO and social proof compounding |

Channel economics snapshot. Organic/GBP is the long-term workhorse (low CAC; steady compounding). Google Ads wins on speed if pages match search intent and show price bands. Referrals convert best—protect those relationships. All roads lead to a clean intake and a proposal that reads like a plan, not a bet.

6. Operations & Management

6.1 Workflow

Tight, traceable, repeatable—so nothing slips.

- Inbound. Lead arrives via website, referral, or phone. Form captures matter type, parties, deadlines, and budget band.

- Conflict check. Automated search + human verification. If conflicted, issue a same-day declination letter.

- Intake. Coordinator books a 20–30 minute consult, collects key documents, opens a provisional matter in the system.

- Scope & fee. Partner frames outcomes, phases, assumptions. Choose fixed / hourly / hybrid; set decision gates for disputes.

- Engagement letter. E-sign + payment link (card/ACH). Retainers/advances land in trust (IOLTA) until earned.

- Matter plan. Milestone timeline with owners and target dates; client sees progress in the portal.

- Execution. Weekly matter reviews; checklists by service line; “quiet weeks” still get a heartbeat update.

- Invoice & feedback. Milestone or monthly billing with clear narratives; short NPS survey; one-page wrap-up summary.

6.2 Technology

- Case management. Matter cards, tasks, deadlines, checklists; calendar integration.

- Timekeeping & billing. Timers, default narratives, automated invoicing, online payments.

- E-signature & client portal. Paperless onboarding, document exchange, real-time status and milestones.

- Document automation. Templates for formations, handbooks, NDAs, demand letters; version control.

- E-discovery (as needed). Lightweight stack for small commercial matters: collection, deduplication, basic review.

- Security. MFA, encryption at rest/in transit, least-privilege access, access logs, regular backups.

6.3 Staffing Model

| Role | FTE Y1 | Core Responsibilities |

|---|---|---|

| Partner(s) | 2 | Rainmaking, pricing/strategy, high-complexity matters, quality control |

| Associate(s) | 1 (→ 2 in Y2) | Research/drafting, discovery, routine hearings, mediation prep, first-pass redlines |

| Paralegal | 1 | Dockets, filings, fact/doc collection, template packaging (formations, trademarks), deadline control |

| Admin / Intake | 0.8 FTE (→ 1.0 by Month 6) | Scheduling, billing/AR, conflicts, lead screening, client-portal support |

Load targets. Associate: 1,400–1,500 billable hours/year (utilization 72–75%). Paralegal: 1,300–1,400 productive hours. Partners: 40–50% billable; remainder to business development, pricing, and QA.

6.4 Compliance & Risk

- IOLTA / trust accounting. Separate accounts, dual-control transfers, monthly reconciliation, transaction logs, client notices for movements.

- Engagement/Declination letters. Mandatory. Clear scope boundaries, assumptions, fixed/hourly/hybrid terms, expenses, retainer policy.

- Conflicts system. Search clients/counterparties/affiliates; record decisions; re-scan when new parties appear.

- Data security. MFA, encryption, least-privilege, vendor NDAs, BYOD controls, phishing training, incident-response plan.

- Malpractice & insurance. Adequate limits; annual coverage review as dispute volume grows.

- Document retention. Retention/destruction policy by matter type; client handoff memo; secure archival delivery.

Operating cadence. Weekly active-matter standups, monthly P&L reviews (realization, DSO, write-downs), quarterly process retros. The goal: fast answers, predictable invoices, and files we’re proud to audit a year later.

7. Financial Plan

How to read this. I’m giving you the numbers and the levers. Assumptions first, then line-by-line projections, then cash and break-even. If a lever moves (rates, utilization, CAC), you’ll know exactly where the model bends.

7.1 Startup Costs

| Category | Cost (USD) |

|---|---|

| Office fit-out / furniture | $55,000 |

| Tech stack (case mgmt, timekeeping, e-sign, portal) | $22,000 |

| Insurance (malpractice, GL) | $15,000 |

| Marketing & website (initial build + first campaigns) | $28,000 |

| Working capital (3–6 months) | $45,000 |

| Total | $165,000 |

7.2 Revenue Assumptions (Year 1)

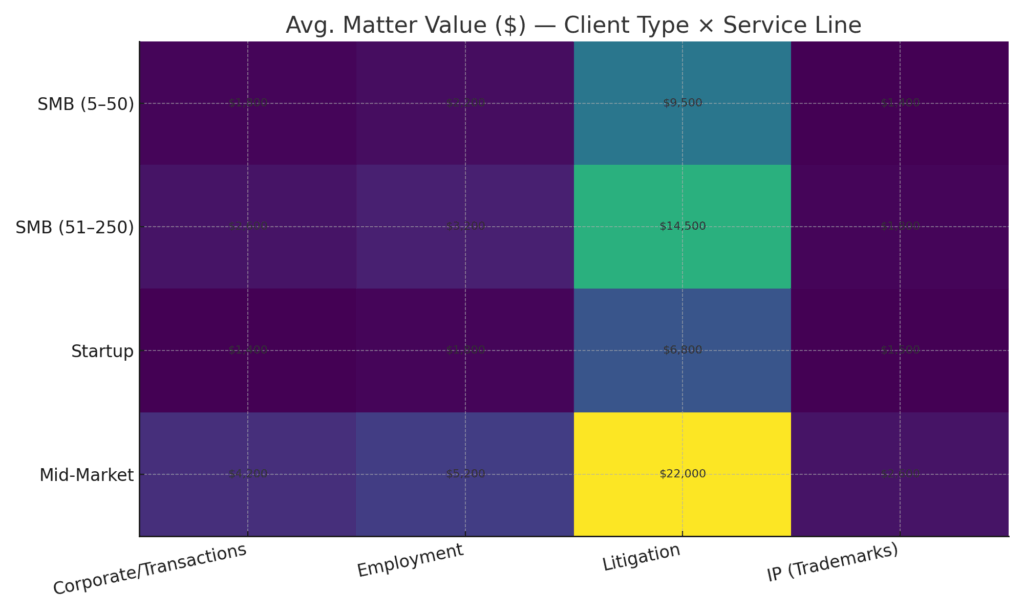

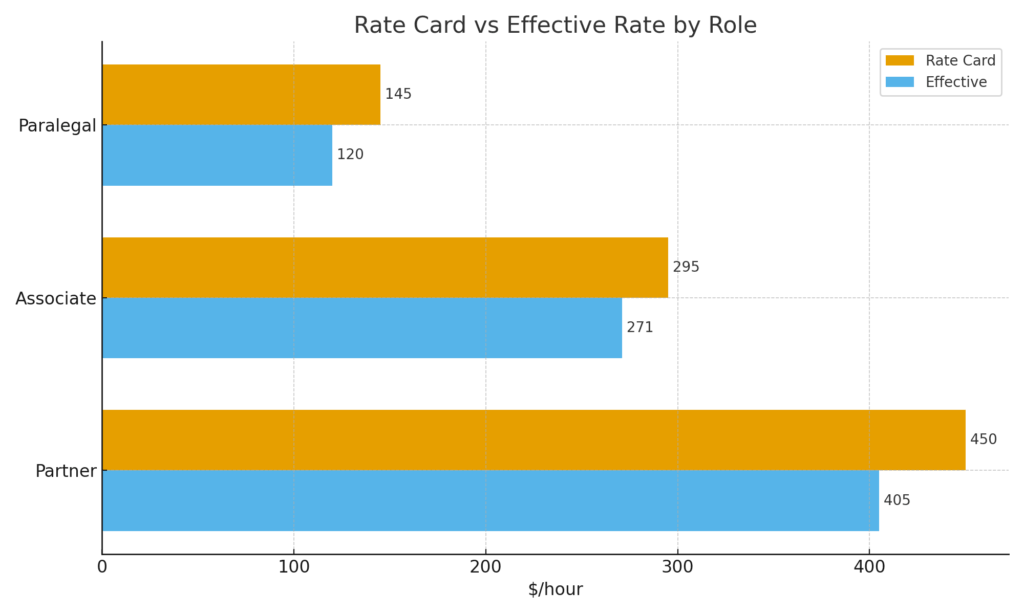

- Rate card (blended effective): Partner $450/hr (90% realization → $405 eff.); Associate $295/hr (92% realization → $271 eff.); Paralegal billed selectively within fixed-fee packages.

- Utilization targets: Associate ~1,400 billable hours; Partners ~540 combined billable hours (rest into BD/QA/pricing).

- Mix: Fixed-fee packages (~$280k), Associate hourly (~$380k), Partner hourly (~$220k), IP filings/add-ons (~$40k).

- Contingency/Hybrid: Used selectively; not counted in base Y1 revenue (upside, not plan-critical).

- Collections/lockup: Average 35 days (WIP + AR); retainers held in trust and drawn as earned.

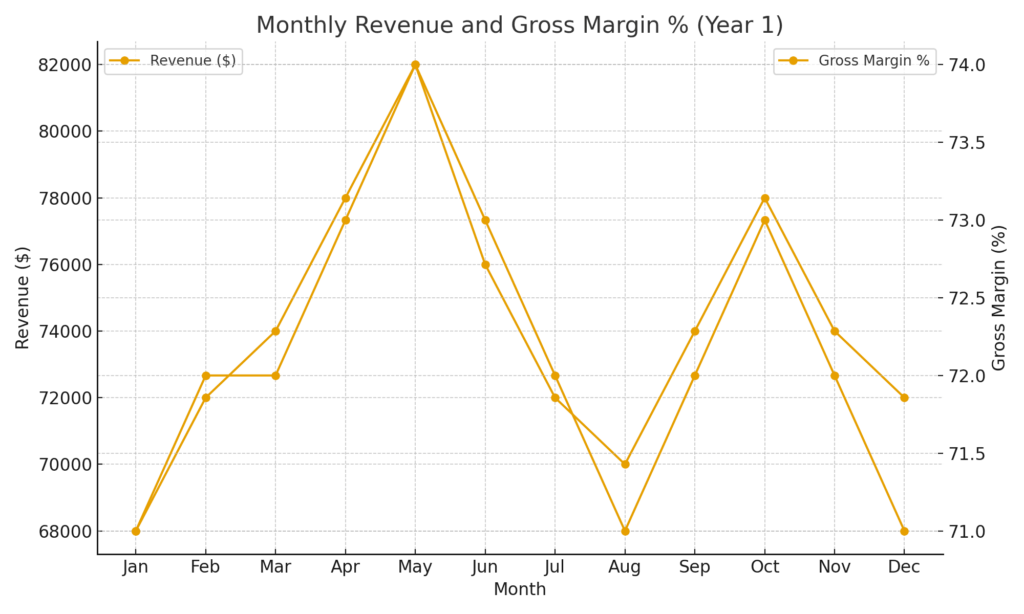

| Month | Revenue (USD) | Gross Margin % |

|---|---|---|

| Jan | $71,000 | 71% |

| Feb | $74,000 | 72% |

| Mar | $77,000 | 72% |

| Apr | $80,000 | 73% |

| May | $85,000 | 74% |

| Jun | $78,000 | 73% |

| Jul | $75,000 | 72% |

| Aug | $72,000 | 71% |

| Sep | $77,000 | 72% |

| Oct | $80,000 | 73% |

| Nov | $77,000 | 72% |

| Dec | $74,000 | 71% |

| Total | $920,000 | — |

Year-1 Revenue total: $920,000 (matching Executive Summary).

7.3 Expenses (Year 1)

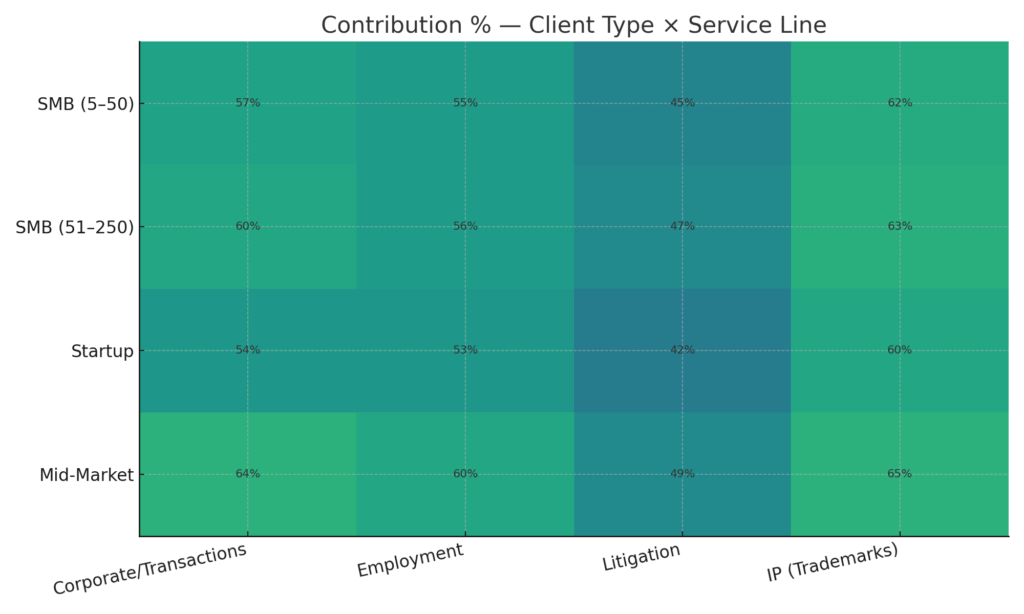

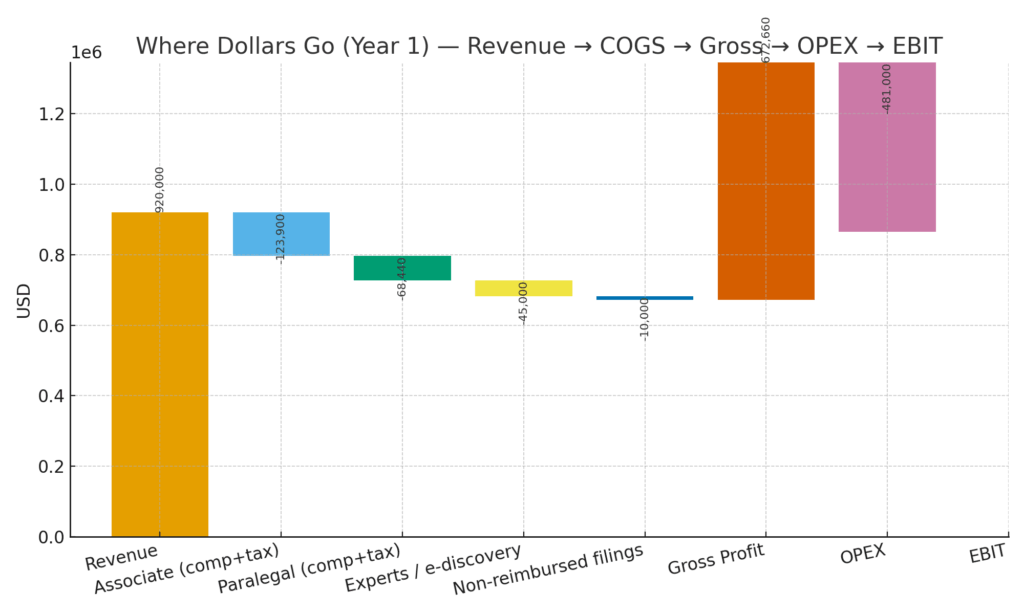

- COGS (direct to matters): Associate comp $105,000 + 18% tax/benefits = $123,900; Paralegal comp $58,000 + 18% = $68,440; Experts/e-discovery $45,000; Non-reimbursed filings/matter costs $10,000. Total COGS ≈ $247,340 (≈ 26.9% of revenue).

- Operating expenses (OPEX): Rent $66k; Tech/SaaS $24k; Insurance $18k; Marketing/BD $96k; Admin/Intake comp (incl. taxes) $45k; Professional fees (CPA/legal) $15k; Office/ops $12k; Travel/education/bar dues $10k; Contingency $15k; Partners’ guaranteed pay (base) $180k. Total OPEX ≈ $481,000.

7.4 P&L Forecast (Y1–Y3)

| Line | Y1 | Y2 | Y3 |

|---|---|---|---|

| Revenue | $920,000 | $1,350,000 | $1,900,000 |

| COGS (Assoc./Para labor, experts) | $248,000 | $378,000 | $551,000 |

| Gross Profit | $672,000 | $972,000 | $1,349,000 |

| Operating Expenses | $481,000 | $620,000 | $770,000 |

| EBIT | $191,000 | $352,000 | $579,000 |

| EBIT Margin | 20.8% | 26.1% | 30.5% |

Notes: Y2 adds a second Associate mid-year; OPEX scales (second intake full-time, bigger ad budget), but operating leverage improves margins. Y3 deepens bench and BD while keeping realization discipline.

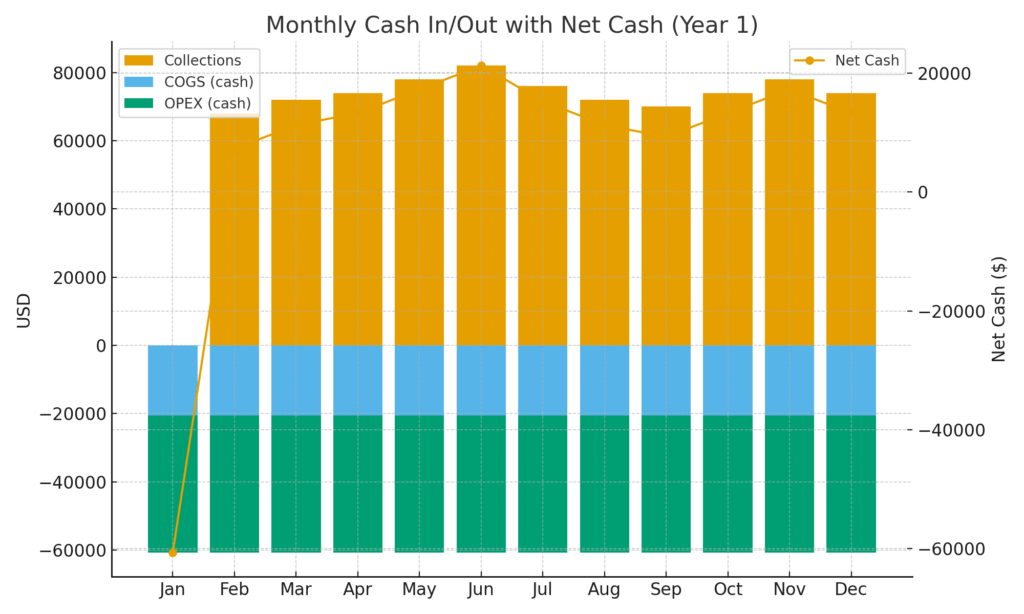

7.5 Cash Flow (Y1 Monthly)

Assumptions: Starting cash from working capital $45k; collections one-month lag (≈35 days); COGS and OPEX paid in month; partner base draws included in OPEX; taxes reserved at 22% of EBIT monthly.

| Month | Revenue | Collections | Cash Out (COGS+OPEX) | Tax Reserve | Net Cash | Ending Cash |

|---|---|---|---|---|---|---|

| Jan | $68,000 | $0 | $60,500 | $0 | −$60,500 | $−15,500 |

| Feb | $72,000 | $68,000 | $60,500 | $0 | $7,500 | $−8,000 |

| Mar | $74,000 | $72,000 | $60,500 | $1,300 | $10,200 | $2,200 |

| Apr | $78,000 | $74,000 | $60,500 | $1,700 | $11,800 | $14,000 |

| May | $82,000 | $78,000 | $60,500 | $2,100 | $15,400 | $29,400 |

| Jun | $76,000 | $82,000 | $60,500 | $1,400 | $20,100 | $49,500 |

| Jul | $72,000 | $76,000 | $60,500 | $900 | $14,600 | $64,100 |

| Aug | $70,000 | $72,000 | $60,500 | $700 | $10,800 | $74,900 |

| Sep | $74,000 | $70,000 | $60,500 | $1,200 | $8,300 | $83,200 |

| Oct | $78,000 | $74,000 | $60,500 | $1,700 | $11,800 | $95,000 |

| Nov | $74,000 | $78,000 | $60,500 | $1,200 | $16,300 | $111,300 |

| Dec | $72,000 | $74,000 | $60,500 | $900 | $12,600 | $123,900 |

Read this: Cash is tight in Q1 (normal with lockup). Working capital covers the dip; by Q2 we’re comfortably positive. If you want a belt-and-suspenders approach, keep a $50k LOC available for “rainy week” smoothing.

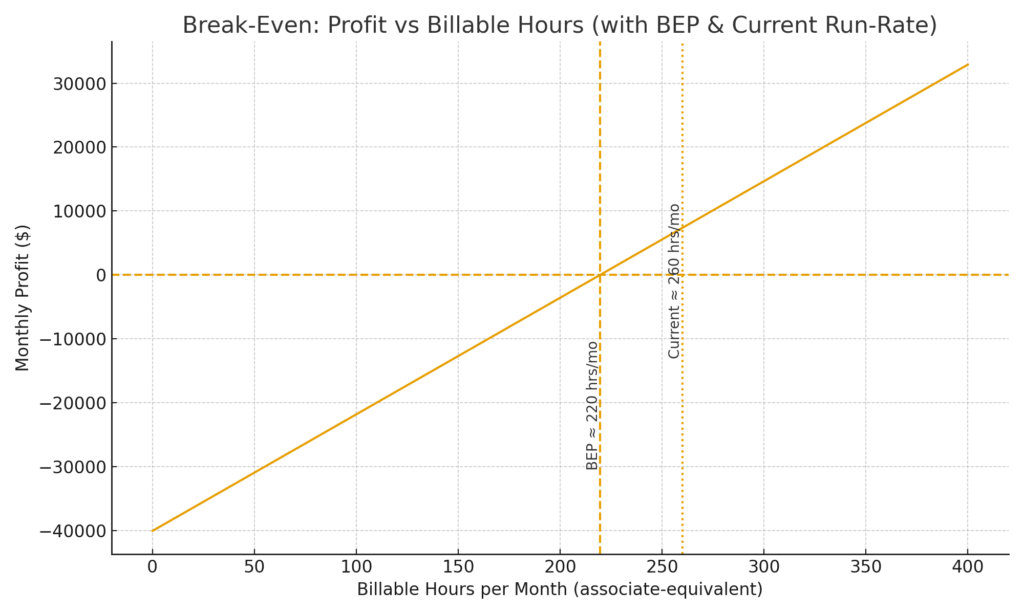

7.6 Break-Even Analysis

- Fixed costs/month (F): OPEX $481,000 ÷ 12 ≈ $40,100.

- Associate contribution/hour (Cm): Effective rate $271 − direct cost/hour ($123,900 ÷ 1,400 ≈ $88.5) ≈ $182.5.

- Break-even billable hours/month: F ÷ Cm ≈ $40,100 ÷ $182.5 ≈ 220 hours (≈ 11 hours/day across the team).

- Fixed-fee equivalent: Avg fixed fee ≈ $1,200 with ~55% contribution ≈ $660 → BE ≈ 61 matters/month.

7.7 Balance Sheet Projection (End of Y1)

| Assets | USD | Liabilities & Equity | USD |

|---|---|---|---|

| Cash | $124,000 | Accounts Payable | $20,000 |

| AR + WIP (≈ 35 days) | $90,000 | Unearned Retainers (Trust) | $40,000 |

| Prepaid/Deposits | $6,000 | Other Liabilities | $5,000 |

| Owner’s Equity | $155,000 | ||

| Total | $220,000 | Total | $220,000 |

Notes: Trust balances are client funds—not revenue—released only as work is performed. Equity reflects initial capital + retained earnings after partner base draws.

7.8 Financial Ratios & Operating KPIs

| Metric | Target / Result (Y1) | Why it matters |

|---|---|---|

| Utilization (Associate) | ~72–75% (≈ 1,400 billable hrs) | Capacity discipline; predictable throughput |

| Realization rate | ≥ 92% associate / ≥ 90% partner | Scope control; fewer write-downs |

| Leverage (Partner:Associate) | 2 : 1 headcount (1 assoc Y1 → 2 in Y2) | Healthy pyramid; protects partner time |

| Average effective rate (AER) | $295 list → $271 effective (assoc) | Pricing power + realization discipline |

| DSO / Lockup | ≤ 35 days | Cash flow stability; less working capital drag |

| Matter profitability | ≥ 30% contribution | Sustainable growth; smarter discounting |

| EBIT margin | ≈ 21% (Y1) → 26% (Y2) → 31% (Y3) | Operating leverage coming through |

Bottom line. The model breaks even around 220 associate-equivalent billable hours/month or ~61 fixed-fee matters/month. With the current mix and pricing, cash tightens early then climbs steadily; margins expand as we add a second associate and keep realization tight. If we need to tune it: raise the fixed-fee floor by $100, trim ad spend by 10% in soft months, and add one more “bread-and-butter” template package—each move adds 1–2 pts of margin without heroics.

8. Funding Requirements & Use of Funds

Amount Requested. $165,000 to cover startup and a 6-month runway.

Use of Funds (allocation).

| Category | USD | Purpose |

|---|---|---|

| Office fit-out / furniture | $55,000 | Conference rooms, privacy booths, secure records room |

| Tech stack (case mgmt, timekeeping, e-sign, portal) | $22,000 | Licenses, setup, integrations, initial data migration |

| Insurance (malpractice, GL, cyber) | $15,000 | Professional liability, general liability, cyber add-on |

| Marketing & website | $28,000 | Site build, content, GBP, launch ads, video intros |

| Working capital (3–6 months) | $45,000 | Payroll timing, vendors, filing fees float, soft-month buffer |

| Total | $165,000 |

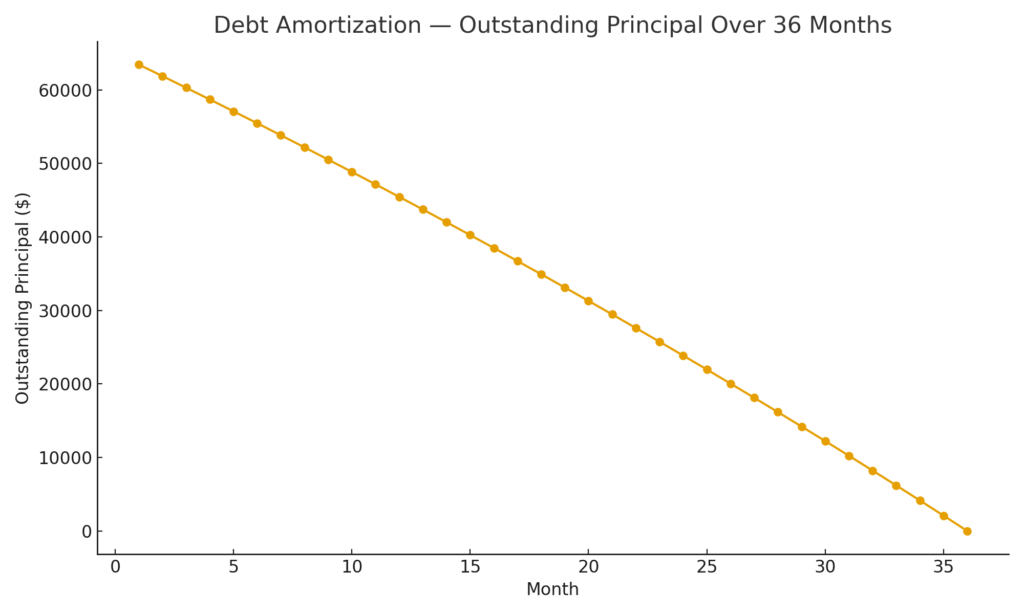

Capital Structure (baseline).

- Partner equity: $100,000 (combined).

- Term loan: $65,000, 36 months, ~9–11% APR (monthly payment ≈ $2,070–$2,140).

- Optional LOC: $50,000 revolving line for AR lockup smoothing (interest-only; use sparingly).

Payback / ROI.

- Debt service coverage (Y1): EBIT ≈ $191,000; annual debt service on $65k ≈ $25,000 → DSCR > 7× (ample cushion).

- Equity payback horizon: With Y1 free cash generation improving after Q1 lockup, we target full equity payback within 18–24 months via retained earnings while maintaining prudent cash reserves.

- Use-of-funds milestones: Office operational by Month 2; tech stack live by Week 4; first marketing cycle in Month 1; working-capital floor maintained at ≥ $35k.

Optional Partner Capital Contributions. If we elect to run debt-light, partners can extend equity to $140,000 and reduce the loan to $25,000 (payment ≈ $800/mo), trading modest dilution of personal liquidity for lower interest cost and even stronger DSCR.

9. Risk Analysis & Mitigation

9.1 Key Risks

- Demand softness. Macro slowdown, fewer new formations, delayed disputes.

- Fee pressure. Low-cost competitors, in-house expansion at clients, procurement on RFPs.

- Malpractice exposure. Calendar misses, scope ambiguity, discovery errors.

- Key-person risk. Over-reliance on a partner for rainmaking or a niche expertise.

- Data / security. Breach, ransomware, vendor compromise affecting client data or trust.

9.2 Mitigation Strategies

- Diversified pipeline. Blend of fixed-fee corporate/employment work (recurring), selective litigation (episodic), and trademark/brand matters (cross-sell). Two primary channels (organic/GBP + referrals) plus targeted Ads on high-intent queries.

- AFAs & scoped budgets. Fixed menus for repeatables; phased budgets and decision gates for disputes/deals to reduce write-downs and maintain realization ≥ 92%.

- Strict QA / review. Dual-calendaring, weekly matter reviews, checklists per service line, second-eye review on filings and dispositive motions.

- Insurance stack. Malpractice with adequate limits, cyber add-on, business interruption; annual coverage review tied to matter mix.

- Documented SOPs. Engagement/declination templates, matter-opening protocols, billing cadence, IOLTA reconciliations (monthly), incident-response playbook.

- Cross-training & bench depth. Associate upskilled across two practice lanes; Of Counsel coverage on trademarks; relationships with reliable local counsel for surge capacity.

- Cybersecurity controls. MFA everywhere, encrypted storage and email, least-privilege access, vendor NDAs, quarterly phishing drills, immutable backups, rapid isolation procedure.

9.3 Contingency Planning

- Financial buffer. Maintain operating reserve ≥ 2× monthly fixed costs; pre-approved $50k LOC; discretionary ad spend dial (±20%) for demand swings.

- Capacity shifts. If demand dips, rebalance to fixed-fee content packages and GC retainers; if demand spikes, deploy pre-vetted contract attorneys and narrow intake to highest-margin matters.

- Crisis communications. Drafted client notices for outages/incidents; internal comms tree; single spokesperson; documented breach notification timelines.

Bottom line. The capital stack is conservative, the plan leans on recurring work and predictable fees, and the controls are built to keep realization high while reducing avoidable risk. That’s the investor-grade core of this law firm business plan.

10. Growth & Expansion Plan

North Star. Scale responsibly: add capacity only when utilization and realization justify it, expand where our niche wins, and automate what humans shouldn’t do.

10.1 Geographic & Practice Expansion

- Phase 1 (Months 1–12): Deepen Miami core; add targeted location pages (Coral Gables, Brickell, Doral). Expand employment + corporate packages; build litigation referral panel.

- Phase 2 (Months 13–24): Extend to Broward (Fort Lauderdale) with shared conference space; launch Hospitality Employment and Construction Contracts micro-niches.

- Phase 3 (Months 25–36): Palm Beach satellite (by-appointment); consider Spanish-first content track; evaluate “light” real estate add-ons if pull is strong.

10.2 Lateral Hires & Bench Building

- Associate #2 (Month 14–18): employment/corporate focus; target portable ~150 billable hrs/month within 60 days.

- Lateral Counsel (as available): commercial litigator with ADR chops; phased-in origination credit; trial support on select cases.

- Paralegal #2 (Month 20–24): trademarks + litigation support; cross-trained on intake QA.

10.3 Niche Specialization

- Hospitality HR & Compliance: handbooks, wage/hour, scheduling rules, tip pooling—fixed-fee bundles + training.

- Construction Trades Contracts: MSAs/SOWs, change orders, lien rights; monthly GC-as-a-Service mini-retainers.

- E-commerce Brand Protection: trademarks, marketplace takedowns, licensing playbooks.

10.4 Referral Partnerships

- CPA & Fractional CFOs: co-authored guides; quarterly co-hosted webinars; shared checklist assets.

- HR Consultants & Recruiters: pipeline both ways (handbooks, IC audits, training).

- Commercial Brokers & Lenders: lease reviews; diligence lists for small acquisitions.

10.5 Thought Leadership

- Monthly “Founder Legal Brief” (email) + quarterly whitepaper tied to a practice niche.

- LinkedIn weekly shorts; case studies (sanitized) with measurable ROI (time saved, dispute avoided).

- Startup legal clinic (monthly) + “GC for a Day” workshops (quarterly).

10.6 Technology Upgrades

- Document Automation: 20+ templates templatized by Month 12; clause library with fallbacks.

- Analytics: matter profitability dashboard; realization by service line; WIP/AR lockup watchlist.

- AI-assisted review (ethics-compliant): drafting suggestions, brief organization, discovery triage; human-in-the-loop only.

10.7 Milestones & Triggers

| Milestone | Trigger | Target Date |

|---|---|---|

| Associate #2 hire | Utilization > 75% for 3 months; realization ≥ 92% | Month 14–18 |

| Broward satellite | Lead share from Broward ≥ 18%; CAC within plan | Month 16–20 |

| Paralegal #2 hire | Paralegal load > 85% + litigation calendar growth | Month 20–24 |

| Palm Beach by-appointment | Monthly matters from PBC ≥ 8; referral density in region | Month 26–30 |

10.8 Growth KPIs

- ARR run-rate; EBIT margin; realization; DSO; lead-to-engagement; referral share; matter profitability by line.

11. Appendix

- Partner resumes/CVs: education, admissions, representative matters, publications.

- Sample engagement & fee agreements: fixed-fee, hourly, hybrid; scope and decision-gate examples.

- Compliance policies: IOLTA/trust accounting SOPs, conflicts procedures, data security & incident response, document retention schedule.

- Financial exhibits: startup budget, 36-month P&L and cash flow, break-even worksheet, sensitivity (price, utilization, realization).

- Marketing assets: brand guidelines, sample landing pages, content calendar, webinar outlines.

- Operations: service-line checklists, template index (formations, handbooks, NDAs, demand letters), QA review sheets.

- Facilities & insurance: office lease/fit-out plan, COI (malpractice, GL, cyber), vendor NDAs/DPAs.

- References & resources: ethics guidance citations, court rules links, Florida Bar advertising guidelines.

Finish line. Capacity grows only when the numbers say so. Niche where we’re pulled, automate where we can, and keep the client experience fast and clear. That’s how this law firm business plan compounds into a durable, profitable boutique.